Planning and budgeting a hospital is not just about bricks and mortar it’s about balancing compliance, patient safety, clinical workflows, and long-term operational efficiency. For healthcare entrepreneurs in Mumbai and Hyderabad, where the demand for modern, NABH-compliant facilities is growing, budgeting requires a structured per-bed approach supported by department-specific capital expenditure (capex) and operating expenditure (opex) planning.

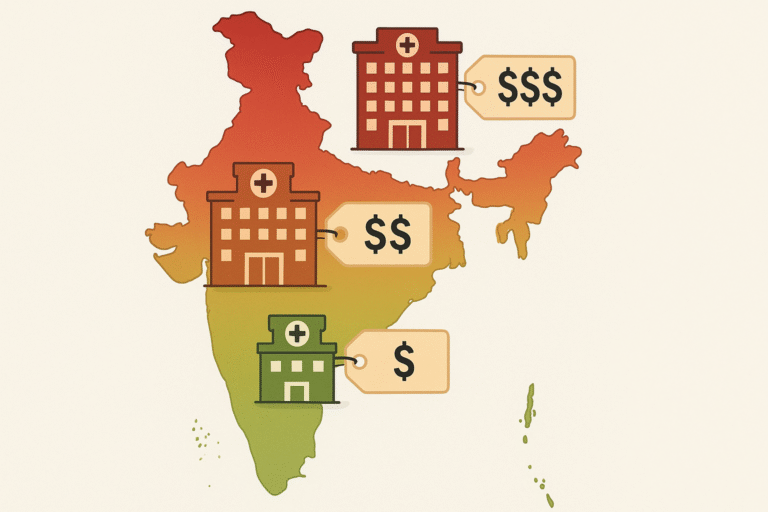

In 2025, multi-specialty hospital projects in India typically require ₹50–90 lakh per bed excluding land, while premium metro builds in Mumbai can touch ₹1 crore+ per bed for high-spec units. Parallel to this, area planning of 600–1,100 sq ft per bed and baseline construction costs of ₹3,200–4,500 per sq ft guide early collaboration between hospital contractors, architects, and MEP consultants to avoid overruns.

Why Use a Per-Bed Budget Model?

-

Standardized Comparison – A per-bed capex model allows hospitals of different sizes and specialties to benchmark against common financial targets.

-

Area Efficiency Link – With planning bands of 600–1,200 sq ft per bed, space efficiency directly impacts project budgets. Smaller hospitals often consume more sq ft/bed due to shared-core inefficiencies.

Land and Built-Up Area

-

Land is usually excluded from direct medical capex comparisons, but plot geometry, zoning regulations, and parking requirements heavily influence overall costs.

-

Built-up area planning at 600–1,100 sq ft per bed is critical, as construction costs in Mumbai and Hyderabad average ₹3,200–4,500 per sq ft.

Construction Cost Baseline

-

Shell-and-core with interiors: ₹3,200–4,500 per sq ft before equipment costs.

-

Specialty upgrades—like isolation HVAC, shielding for diagnostic units, and cleanrooms—add premiums.

-

Hidden costs like power augmentation, IT networks, and digital compliance systems can increase budgets by 10–15% if not planned early.

Compliance and NABH Impact

-

NABH 6th edition standards mandate infection control systems, digital records, fire safety, and workflow compliance.

-

While this increases upfront costs, NABH certification significantly enhances patient trust, insurer partnerships, and long-term operational efficiency.

Budgeting for Different Hospital Areas

Patient Rooms and Wards

-

Standard Rooms: Budget for finishes, medical gases, nurse call systems, HVAC, and furniture.

-

Private & Deluxe Rooms: Higher fit-outs, ensuite bathrooms, and acoustic treatment increase costs but improve patient experience.

Intensive Care Units (ICUs)

-

ICUs require higher air changes, pressure zoning, redundant gas supply, advanced monitoring, and isolation facilities.

-

For large-scale projects, ICU budgets often see 30–40% allocated to equipment.

Operating Theatres (OTs)

-

Among the highest capex zones due to cleanroom finishes, sterility protocols, class-specific HVAC, UPS backup, and surgical lighting.

-

Early integration of CSSD and sterile corridors prevents costly redesigns.

Diagnostics: Radiology

-

CT Suites: Require lead shielding, HVAC stability, and UPS.

-

MRI Suites: Require RF shielding, vibration control, and cryo-safety measures.

-

While scan tariffs generate revenue, upfront fit-out and shielding costs remain unavoidable.

Laboratory Services

-

Labs need zoning, HVAC control, LIS/IT integration, reagent storage, and QA systems.

-

Investment ranges from ₹10–20 lakh for small setups to ₹2 crore+ for mid-to-large hospital labs with automation and accreditation-ready QC systems.

Emergency and Day-Care Units

-

Emergency departments need triage bays, resuscitation rooms, negative-pressure isolation, and proximity to diagnostics.

-

Dialysis and day-care can be cost-efficient but require infection control and water treatment integration.

IT, Digital, and Cybersecurity

-

EMR, PACS, LIS, and secure networks are now core capex lines.

-

Cybersecurity measures such as data backup, access controls, and compliance with NABH standards must be planned at DPR stage.

Services: HVAC, Gases, and Power

-

HVAC dominates costs in ICUs, OTs, and isolation areas.

-

Medical gases, vacuum systems, and redundant power (gensets/UPS) significantly shape per-bed cost envelopes.

Operating Cost Considerations

-

ICU operational costs can reach ₹11,000+ per bed per day in public-sector contexts, with staffing as the largest driver.

-

Labs and imaging require consistent allocation for consumables, calibration, and QA, impacting long-term margins.

Mumbai and Hyderabad Market Realities

-

Mumbai: Higher real estate costs, compliance intensity, and metro-specific design requirements push per-bed costs to the upper benchmark range.

-

Hyderabad: Larger land parcels and scale efficiencies can optimize costs, but specialty services like ICU and diagnostics still command premium budgets.

Sample Budget Structure

-

Shell and Core: Structure, facade, and base MEP (₹3,200–4,500/sq ft).

-

Interiors & Fit-Out: Rooms, ICUs, OTs, diagnostics, and sterile zones.

-

Medical Equipment: Up to 40% of one-time costs for ICU, OT, imaging.

-

Digital Systems: EMR, PACS, LIS, cybersecurity, IoMT integration.

-

Soft Costs: Architecture, design, project management, NABH licensing, and contingencies (10–15%).

How Hospital Contractors and Architects Add Value

-

Hospital Contractors in Mumbai and Hyderabad: Manage permits, phasing, and MEP execution to minimize overruns and delays.

-

Hospital Architects in Mumbai: Optimize clinical adjacencies, vertical cores, infection control, and area efficiency to keep budgets within target ranges.

Final Word

Building a hospital in Mumbai or Hyderabad requires granular, department-wise budgeting with strict alignment to NABH, clinical needs, and local market realities. By starting with a per-bed financial model and engaging experienced hospital contractors and architects early, healthcare entrepreneurs can reduce cost overruns, accelerate timelines, and ensure sustainable operations post-launch.